The two leading stablecoins are seeing increased inflows into centralized exchanges, suggesting a potential buying spree.

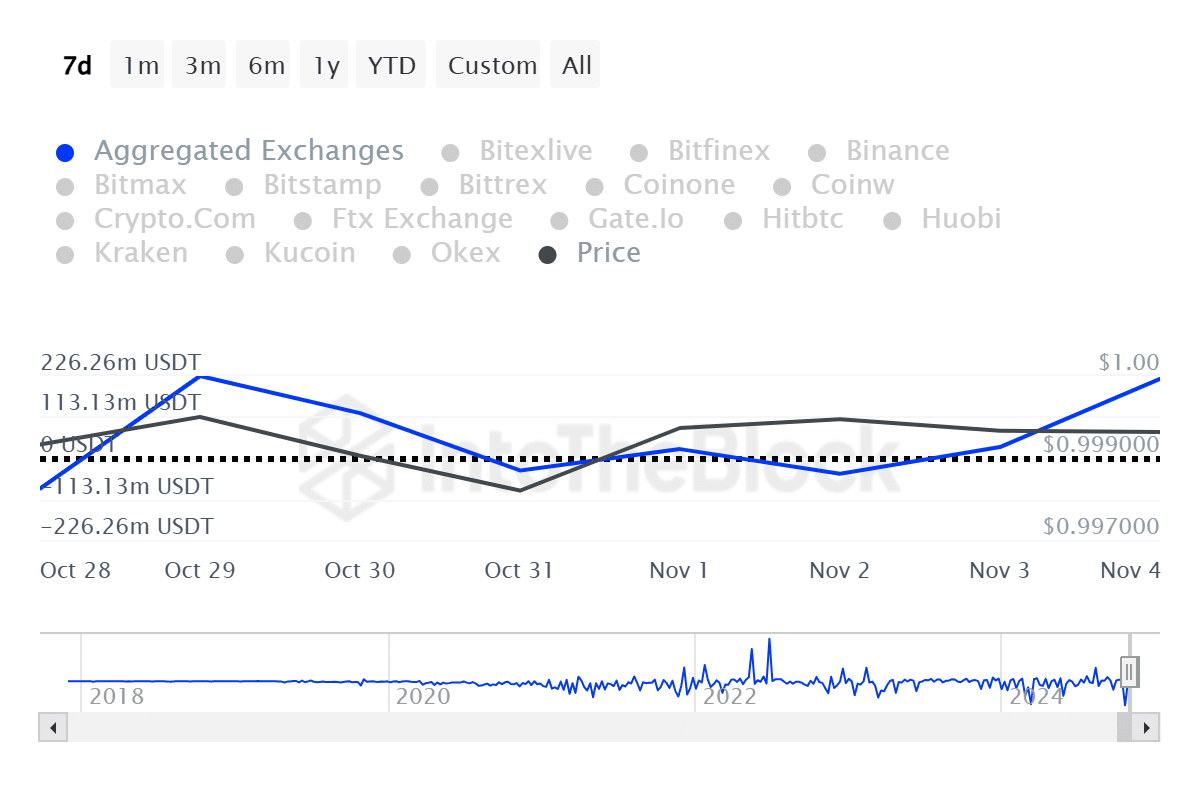

According to data provided by IntoTheBlock, Tether (USDT) saw its exchange net flows rise from a net outflow of $43 million on Nov. 2 to a net inflow of $218 million on Nov. 4.

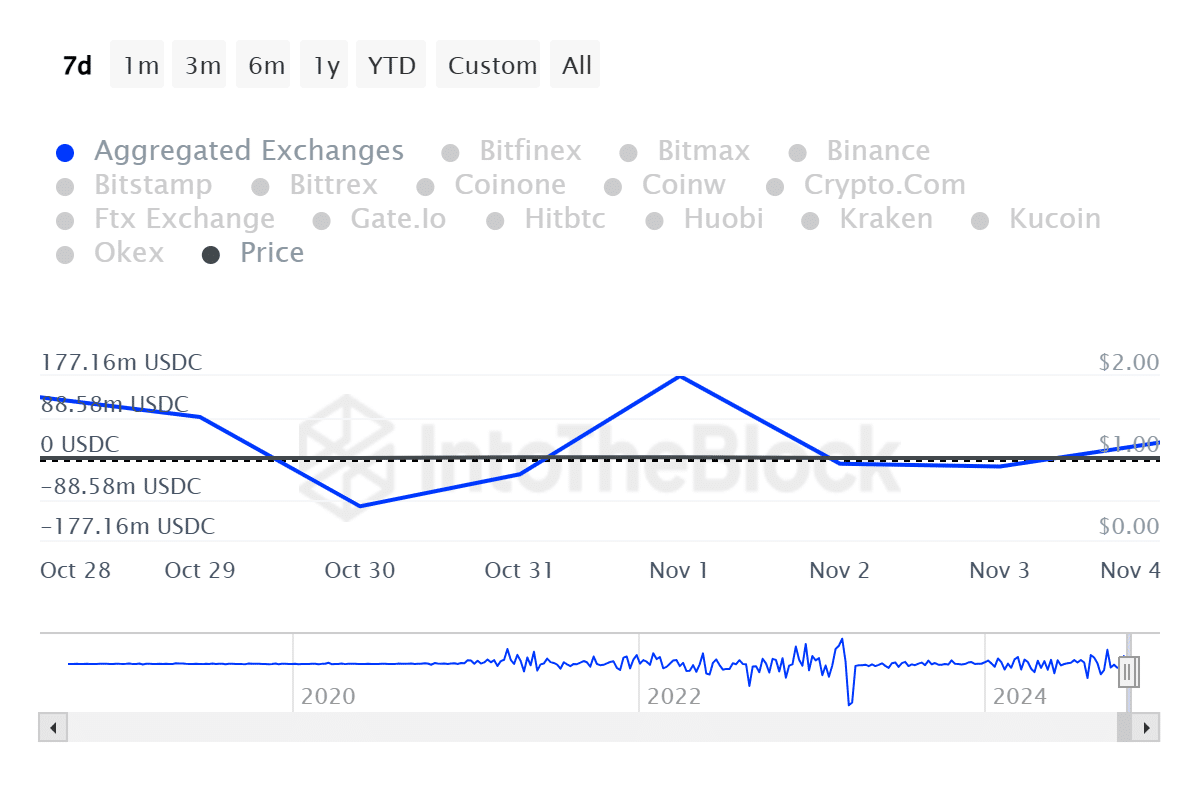

Data shows that USD Coin’s (USDC) CEX net flows also shifted from a net outflow of $18.5 million on Nov. 3 to a net inflow of $33.6 million yesterday.

The total amount of stablecoins entering cryptos exchanges surpassed the $250 million mark on Nov. 4, ITB data shows.

The bullish case

Stablecoin inflows usually suggest the investor enthusiasm to accumulate Bitcoin (BTC) and altcoins. According to data from CoinGecko, the global crypto market capitalization has already started rising from its local low of $2.33 trillion to $2.39 trillion—marking a $60 billion in less than a day.

The daily whale transactions consisting of at least 100,000 USDT and USDC also increased by 187% and 190%, respectively—reaching $6.62 billion and $8.93 billion, per ITB data.

Increasing whale activity could potentially create the fear of missing out, also known as FOMO, among market participants. It could also show a sign of potential recovery after the market-wide correction.

According to ITB, the total stablecoin market cap declined from $172 billion to $169 billion over the past month.

One of the main factors behind the market correction was the start of BTC exchange-traded fund outflows this month. Per a crypto.news report, spot Bitcoin ETFs in the U.S. saw their second-largest outflow on Monday, worth $541.1 million. The outflows came after the investment products recorded a net inflow of over $5 billion last month.

No Comments